I spend a lot of time thinking about asymmetrical risk.

Specifically…

Where the upside of an action…

And the downside of an action…

Aren’t equally weighted. ⚖

Let me give you an example…

And it comes from billionaire real estate investor, Sam Zell.🤑

Zell is Jewish…

And, on the evening of August 24th, 1939, Sam’s father, mother, and sister packed up their belongings and left their home in Poland.

In hindsight, with the rising tide of anti-semitism in Europe, it’s easy to think their decision to leave was an obvious one…

But just that morning, Sam’s father had no immediate plans to leave his home.

He’d been on a train heading towards Warsaw for a business trip…🚆

When, at one of the train stops, he saw a newsboy selling papers…

When, at one of the train stops, he saw a newsboy selling papers…

And the paper’s headline was that Germany and Russia had signed a non-aggression pact.

When Sam’s father saw this headline…

He immediately got off his train, walked across the platform, and boarded a different train back to his village.

Why?

Sam’s dad believed that this “nonaggression pact” was really just an agreement to divide up Poland…

Which meant his country was about to be invaded from both sides…

And he reasoned the Germans would get to his village first.

Zell’s father got home at 2 pm…

And he told his wife to pack everything she could, because they were leaving on the 4 pm train out.

That’s exactly what happened.

They took the 4 pm train to a relative’s house about 75 miles away…

They took the 4 pm train to a relative’s house about 75 miles away…

And then Sam’s father went back to his village one final time…

To beg his family and friends to leave with them.

They all thought he was crazy…

He couldn’t persuade a single one of them to go…

And, believing time was short…

Sam’s father reluctantly left the village where he’d lived his entire life…

Saying goodbye to everyone he’d ever known or loved…

And joined his wife and daughter on a train to Lithuania.

The Nazis invaded Poland the next morning at dawn…

And one of the first things they did was bomb the railroad tracks…

Meaning that Sam’s parents and sister had taken what was literally the very last train out of Poland.

It’s an incredible story…

And it also demonstrates the concept of asymmetrical risk-taking perfectly.

Thank about it:

As “drastic” as the decision to leave Poland was…

There’s actually a lucid logic to it.

Sam’s dad was making a calculated wager.

If he’s wrong…

He and his family spend a few weeks in Lithuania…

Then they head back home to Poland.

In that situation…

The worst thing that happens is he looks “foolish” to his family and friends.

Nobody wants to look dumb…

But the downside there really isn’t that severe.

But the downside there really isn’t that severe.

And meanwhile, if Sam’s dad is right (which he was)…

What happens, then?

Well, as it turns out…

Out of all his family members who stayed in Poland…

All but two of them ended up dying in the concentration camps.

So the upside to being “right” meant the continued survival of Sam’s dad and his entire family…

While the downside of being “wrong” meant looking foolish and being teased.

That’s asymmetry.

And while this example in a dramatic one…

And while this example in a dramatic one…

Asymmetry is a principle that can be applied everywhere.

Like I mentioned at the beginning of this blog post…

Sam Zell is a billionaire…

And if you read his book, or listen to his interview on the Tim Ferris Podcast…

He's constantly talking about asymmetrical risk.

Why?

It gives you this inherent edge in everything you do because the odds are always stacked in your favor.

For Sam, a lot of his risk-taking happens in the world of real estate…

But what I’ve found, is that when it comes to billionaires and other ultra-successful people…

They all live by the principle of asymmetry as well.

Nassim Taleb became a legendary options trader through asymmetrical risk-taking (net worth: somewhere in the 9 figures, plus he’s also written three books on this concept)…

And Jeff Bezos swears by asymmetry, too. His whole ethos is to constantly be taking hundreds of small, calculated risks…

With the idea being that he’s playing the spread…

And that the upside of the bets he gets right will drastically outweigh the downside of the bets he gets wrong.

Sound familiar?

It should, because that’s what the entire Venture Capital model is based on, too.

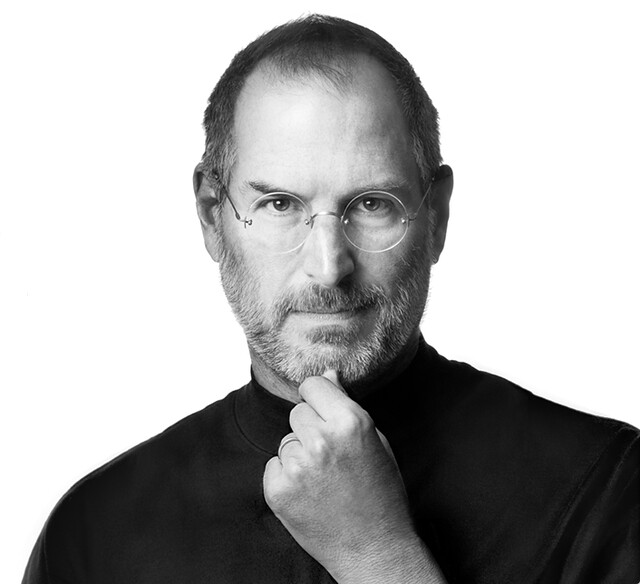

Oh, and then there’s Steve Jobs.

When he was first pushing for the iPod at Apple…

When he was first pushing for the iPod at Apple…

Most of his engineers and the executive team thought he was crazy.

“Focus on hardware,” they said…

“Making an MP3 player is risky.”

And they weren’t wrong.

But, Steve Jobs wagered that if he was right about the iPod…

And if digital music was going to explode the way he thought it would…

Then the upside of being dominantly positioned in that vertical…

Was worth the risk of diverting some resources from Apple’s struggling hardware division.

As it turns out, Steve was right…

Because in 2001, Apple had something like $200 million in cash and $500 million in debt…

Yet, seventeen years later, the company reached a market cap of over $1 trillion.

Pretty big upside, right?

So, this is why for me,

personally…

personally…

I’m beginning to

spend more and more time looking for asymmetrical opportunities in my business and my life too.

It’s easy for me to do this, since I’m a bit of a gambler by nature…

But it’s also important

to realize that leveraging the power of asymmetry isn’t about taking blind risks…

It’s about taking calculated ones.

And, just like with gambling…

The key is to have as much information as possible…

That way, you maximize the upside if you’re right.

– SPG

P.S. This post originally came from an email I sent to my private list. If you want to see more stuff like this from me, you can apply to join my list using this link.

0 Comments